Your chosen service provider will handle many aspects of your financial operations, and this may lead to concerns about transparency and decision-making. Outsourcing providers have advanced technologies and streamlined workflows that can significantly improve the accuracy and speed of invoice processing. Additionally, outsourcing providers often have established processes and technology that can streamline invoice processing and payment, further reducing operational expenses. The choice between outsourcing and automation depends on various factors including the company’s size, internal resources, and long-term financial strategy.

Intelligent Data Extraction: Everything you need to know in 2024

- Outsourcing accounts payable gives you access to a team of experts who specialize in financial processes.

- These providers stay at the forefront of industry best practices, offering insights and strategies that might be beyond the scope of an in-house team.

- When considering a major change to your processes, it helps to explore all your options.

- Efficient invoice receipt and processing can lead to cost savings and improved accuracy, reducing the likelihood of manual data entry errors and facilitating better cash flow management.

- They also provide comprehensive reporting and analytics, giving you valuable insights into your financial health.

Uptime and accountability – Given that this is their sole purpose, your AP needs will receive a lot of attention. It’s not as if the vendor is a mix of roles from CFO and Controller, to AP Manager and AP Processor, which can happen at smaller firms—one person wearing many hats. Depending on where the vendor is located or if they have a distributed staff, you may find one with near-constant uptime when they are utilizing technology like AP Automation.

Improved efficiency

Working with an external team may lead to communication challenges, especially if they are located in different time zones or have cultural differences. As you outsource AP tasks that were previously carried out by the in-house team, your employees might have different responsibilities and day-to-day tasks. While you may not be able to access the exact data about their projects, case studies and accounts of the provider’s previous work give you an idea about their quality. To outsource your accounts payable easily, here’re a few things to keep in mind. Most businesses have a few exceptions and business rules in their interpreting r output for simple linear regression part 1 accounts payable workflow. Outsourcing accounts payable takes most of this workload off of your AP team supervisor.

While cost is an important factor, it should not be the only consideration. This includes not just the direct costs saved but also the indirect benefits like increased efficiency, a guide to nonprofit accounting for non-accountants reduced errors, and better cash flow management. A provider offering services at a very low cost might not always deliver the quality or breadth of services needed. ILM is a Virginia-based provider of accounts payable services to commercial clients, government entities, and nonprofits.

Why accounts payable outsourcing is gaining popularity

These challenges can result in misunderstandings and delays in communication, which can adversely affect the accuracy and timeliness of services provided. Furthermore, by working with an AP outsourcing provider, businesses can ensure that they maintain a high level of compliance with financial regulations and industry best practices. In addition to invoice receipt and data capture, ILM also offers services such as PO matching, invoice processing and routing, disbursement, types of dividends accrual, general ledger, and archiving functions.

Order.co helps high-performing clients in diverse industries increase the efficiency of their procurement process. Financial audits gives companies an objective read of their financial statements. You’ll know every approval workflow was checked and applied automatically. But with the right automation solution, switching to automation isn’t a headache at all. Each advantage on that list is actually a benefit of automation, not outsourcing in and of itself. Set up touchless AP workflows and streamline the Accounts Payable process in seconds.

Privacy and security issues

It would take you a week just to set up introductory calls with outsourced vendors. Potentially reduced costs – It’s possible that outsourcing your AP duties will be more cost-effective than hiring and training your own team. You won’t have insurance, pensions, or office space and equipment to worry about, so depending on your situation, outsourcing may save you money. In addition, you’ll enjoy the same availability of your data, the same control over compliance workflows, the same detailed invoice and payment tracking, with the same standardization of your AP process. An AP outsourced business solution might sound like it operates more efficiently, so it can improve your bottom line. But as a general rule, that’s because they’re using more efficient technologies.

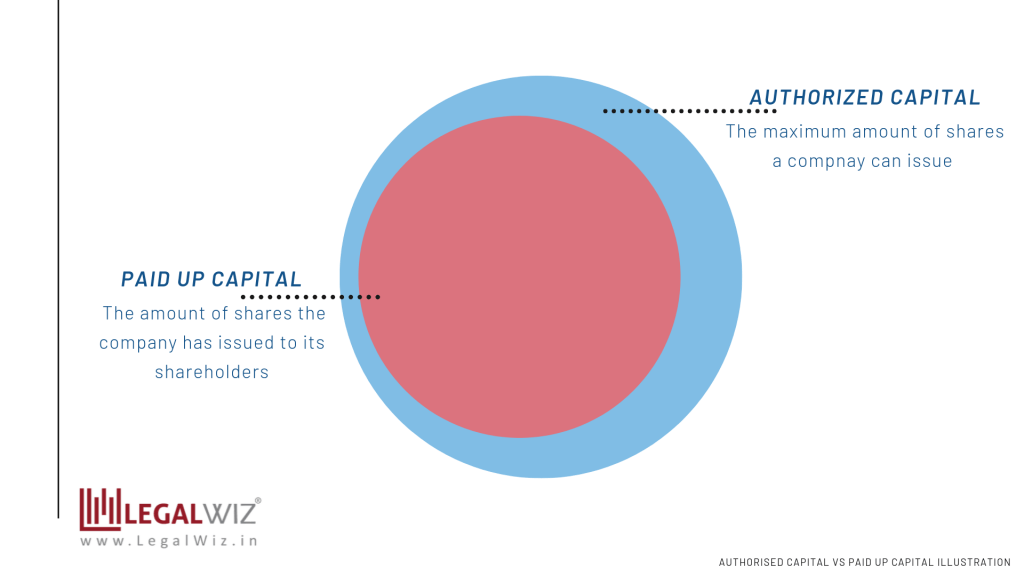

This means that you use the accounts payable services of an external entity to perform your business transactions. AP Automation, in comparison, is the adoption/integration of an AP software to extract, validate and approve accounts payable invoice processes. The decision to outsource accounts payable is a strategic one that depends on your organization’s unique needs, resources, and goals. Weigh the pros and cons carefully, considering factors such as cost savings, expertise, and data security. With the growing importance of data security, outsourcing providers will continue to invest in robust security measures and compliance standards to protect sensitive financial information.