The downside to this method is that the merchant does not have the customer’s authorization to charge their card if they do not pay the invoice on time. Some businesses prefer to set up recurring invoices rather than charge the customer’s card automatically. In this case, the business sends an invoice according to a schedule, and then the customer pays the invoice manually. Business owners on a budget who have limited recurring payments to process will like the free service offered by Zoho. The platform scales as the business grows, making it a comprehensive solution.

Can customers easily cancel or modify their recurring billing subscriptions?

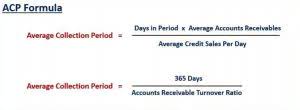

You can give your clients greater peace of mind by allowing them to set up recurring payments, because it offers a more secure method of payment. By accepting recurring payments, your business can be assured of a steady flow of cash entering your bank account reliably each month. With a predictable cash flow, you’ll be better equipped to cover your business expenses and any emergency costs that come up. Recurring payments also help you create accurate cash flow projections, since you’ll be better able to predict the money coming into your business every month. If you’d rather not store your customer’s payment data and charge their credit card or debit card automatically, you can also set up recurring invoices using these instructions.

- For example, merchants must contact consumers about updating their payment information if a credit card expires or a credit card issuer declines an attempted recurring charge.

- Many merchants use sophisticated systems to help them manage all aspects of recurring billing.

- She brings practical experience as a business owner and insurance agent to her role as a small business writer.

- Simply sign in to your account to get a snapshot of upcoming bills and subscription payments, along with expected due dates and charge amounts.

- Each of these services is designed to help businesses offer and manage recurring billing and payments.

Enhanced Customer Retention

Both subscription and recurring billing involve an auto-pay system, storage of customer’s payment information, and periodic withdrawal of credit from the customer’s account. Apart from auto-charging, other payment methods like cash and check are allowed in both subscription systems and recurring billing. Recurring billing is a basic form of subscription billing, they can be considered one and the same. Both recurring billing and subscription billing require a customer to approve automatic charges at a set interval in exchange for access to a business’s goods or services. Interestingly, recent data reveals that subscription companies have largely shifted to usage-based payment options. According to a 2023 survey on usage-based billing, 61% of SaaS (software-as-a-service) companies either adopted this billing model or are testing it.

What Are the Different Types of Recurring Billing?

Recurring payment for SaaS companies offers subscription-based access to software solutions. For instance, Slack, https://www.bookstime.com/blog/accounting-for-technology-companies a team communication platform, charges its customers on a per-user basis monthly or annually. Dropbox, a cloud storage service, offers premium subscriptions with recurring payments.

- Furthermore, recurring billing allows businesses to establish long-term relationships with their customers.

- However, in recurring billing, having different tiers of pricing is not necessary because irrespective of the pricing plan, the billing mechanism remains the same.

- Managing recurring payments can be more complex than managing one-time sales.

- Many businesses provide both options, offering flexibility to meet varied customer needs.

- This enhances customer retention as discontinuing services requires canceling recurring charges, a process some may find cumbersome.

What is Recurring Billing? Definition, Types Advantages – Zoho Billing

From then onwards, bills are generated, and payments are collected with no further manual intervention. To process recurring payments, a business needs a merchant account or payment service provider, both of which allow you to accept payments electronically. Because the customer is not present when the card is charged, it’s a good idea to have customers sign an authorization to allow the charges on a regular schedule. Customers expect a relevant, familiar payment experience, and the easier you make the payment process, the more likely you are to generate sales. For subscription-based business models, companies often collect credit card information during checkout fixed assets and then charge the card every month in the background. However, you should also ensure that your billing solution supports a variety of payment methods, such as ACH credit, ACH debit, checks, digital wallets, and bank transfers.

- You’ll also want to consider the integrations that you need with other business tools that you use.

- Think about popular SaaS applications such as Google Apps, Slack, or Dropbox.

- To avoid errors in the recurring payment process due to something like insufficient funds, ensure you always have updated card or bank information from the customer.

- With accurate forecasts, you can make more educated growth decisions, investing wisely in sales and marketing without fear of overspending.

- Yet, their questionable reliability may force you to consider an alternative.

Managing recurring payments can be more complex than managing one-time sales. You need the right tools and processes in place for tracking customers on different billing cycles, paying different amounts, and with different contract lengths. recurring billing Most SaaS companies combat this complexity by using an integrated subscription management tool that helps ensure customers are always charged the right amount at the right time. Recurring billing is a type of subscription billing model that allows businesses to collect recurring payments from customers at regular intervals.

- To set up PayPal Recurring Payments, you must have a PayPal Business account.

- When recurring billing is used, it can be important to tie it to a major checking or savings account with a high balance.

- Check out how UpCodes simplified and scaled their recurring billing operations with Chargebee.

- Fixed billing involves collecting a consistent, predetermined amount from customers in each payment cycle.

- Unfortunately, there is quite a lot of variability here among the best payment gateway providers for online businesses.

Instead, the payment is automatically deducted from their preferred payment method, ensuring a seamless and uninterrupted service. For businesses, recurring billing eliminates the need for manual invoicing, saving time and resources that can be allocated to other important tasks. Subscription billing and recurring billing are terms often used interchangeably. Yet, a subtle difference exists between them, which is crucial for your business operations.