Investopedia contributors come from a range of backgrounds, and over 25 years there have been thousands of expert writers and editors who have contributed. You work it out by dividing your contribution margin by the number of hours worked. As of Year 0, the first year of our projections, our hypothetical company has the following financials.

Our Services

In the same case, if you sell 100 units of the product, then contributing margin on total revenue is $6,000 ($10,000-$4,000). However, when CM is expressed as a ratio or as a percentage of sales, it provides a sound alternative to the profit ratio. The best contribution margin is 100%, so the closer the contribution margin is to 100%, the better.

How confident are you in your long term financial plan?

Let us understand the formula that shall act as a basis of our understanding of the concept of per unit contribution margin through the discussion below. In effect, the process can be more difficult in comparison to a quick calculation of gross profit and the gross margin using the income statement, yet is worthwhile in terms of deriving product-level insights. The analysis of the contribution margin facilitates a more in-depth, granular understanding of a company’s unit economics (and cost structure).

Contribution Margin Ratio Calculation Example

Alternatively, it can also be calculated by multiplying the Contribution Margin Per Unit by the total quantity of units sold. In this example, if we had been given the fixed expenses, we could also find out the firm’s net profit. When there’s no way we can know the net sales, we can use the above formula to determine how to calculate the contribution margin. The higher a product’s contribution margin and contribution margin ratio, the more it adds to its overall profit.

Thus, \(20\%\) of each sales dollar represents the variable cost of the item and \(80\%\) of the sales dollar is margin. Cost volume profit (CVP) analysis is a managerial accounting technique used to determine how changes in sales volume, variable costs, fixed costs, and/or selling price per unit affect a business’s operating income. The focus may be on a single product or on a sales mix of two or more different products. As you will learn in future chapters, in order for businesses to remain profitable, it is important for managers to understand how to measure and manage fixed and variable costs for decision-making. In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making. We will discuss how to use the concepts of fixed and variable costs and their relationship to profit to determine the sales needed to break even or to reach a desired profit.

- In other words, it measures how much money each additional sale «contributes» to the company’s total profits.

- The calculation assesses how the growth in sales and profits are linked to each other in a business.

- A university van will hold eight passengers, at a cost of \(\$200\) per van.

- Conversely, a lower margin may signal the need to review costs, pricing strategies, or product offerings to improve profitability.

- At the same time, both measures help analyze a company’s financial performance.

Managerial Accounting

Reduce variable costs by getting better deals on raw materials, packaging, and shipping, finding cheaper materials or alternatives, or reducing labor costs and time by improving efficiency. It includes the rent for your building, property taxes, the cost of buying machinery and other assets, and insurance costs. Whether you sell millions of your products or 10s of your products, these expenses remain the same. Fixed and variable costs are expenses your company accrues from operating the business.

Watch this video from Investopedia reviewing the concept of contribution margin to learn more. Keep in mind that contribution margin per sale first contributes to meeting fixed costs and then to profit. Typically, variable costs are only comprised of direct materials, any supplies that would not be consumed if the products were not manufactured, commissions, and piece rate wages. Piece rate wages are paid based on the number of units produced; for example, if the piece rate wage is $4 per unit and a worker produces 10 units, then the total piece rate wage is $40. The contribution margin is affected by the variable costs of producing a product and the product’s selling price.

In conclusion, we’ll calculate the product’s contribution margin ratio (%) by dividing its contribution margin per unit by its selling price per unit, which returns a ratio of 0.60, or 60%. On the other hand, variable costs are costs that depend on the amount of goods and services a business produces. The more it produces in a given month, the more raw materials it requires.

The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources. Say that a company has a pen-manufacturing machine that is capable of producing both ink pens and ball-point pens, and management must make a choice to produce only one of them. A contribution margin analysis can be done for an entire company, single departments, a product line, or even a single unit by following a simple formula. The contribution margin can be presented in dollars or as a percentage. You need to work out the contribution margin per unit, the increase in profit if there is a one unit increase in sales. Now that we understand the basics, formula, and how to calculate per unit contribution margin, let us also understand the practicality of the concept through the examples below.

If they send one to eight participants, the fixed cost for the van would be $200. If they send nine to sixteen students, the fixed cost would be $400 because whitepapers on accounting and cloud technology they will need two vans. We would consider the relevant range to be between one and eight passengers, and the fixed cost in this range would be $200.

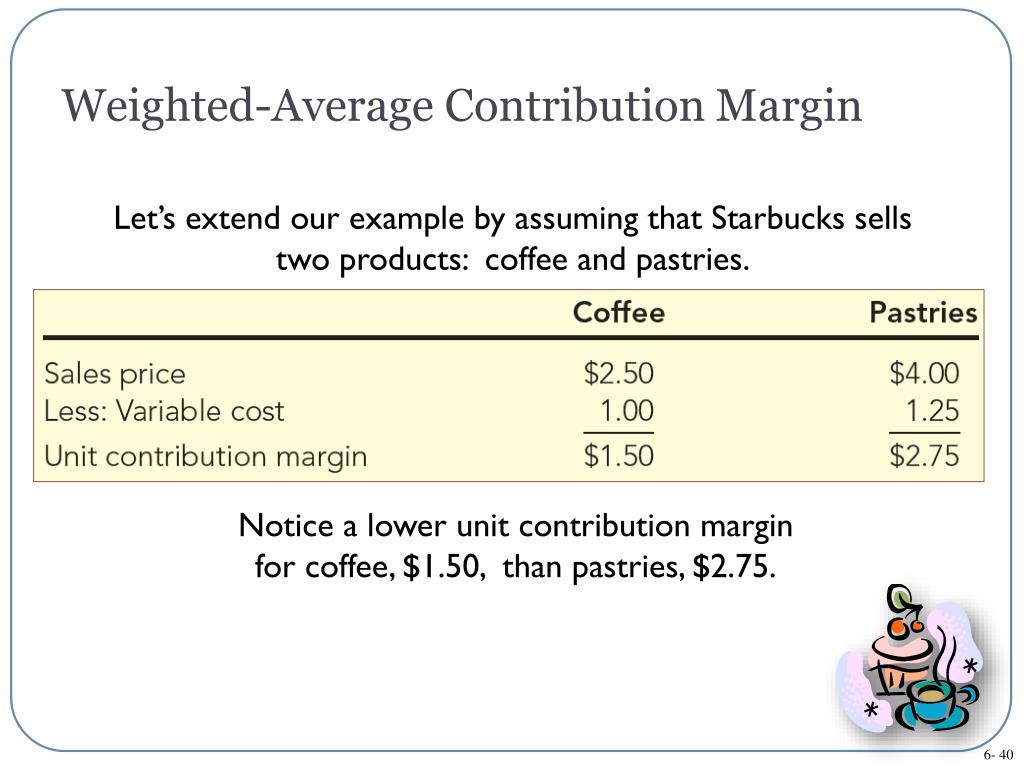

The key component of the contribution per unit calculation that can cause difficulty is the variable cost. Thus, it should not include any overhead cost, and should rarely include direct labor costs. Direct labor costs are actually a fixed cost when a production line is used, since it requires a certain fixed amount of staffing to operate the line, irrespective of the number of units produced. It means there’s more money for covering fixed costs and contributing to profit. Weighted average contribution margin per unit equals the sum of contribution margins of all products divided by total units.