Before you even send out an invoice, it’s crucial to assess the creditworthiness of your what is a deferred interest credit card customers. This is especially important if transactions involve significant sums and extended payment terms. When you do sales on credit, you would certainly need to keep track of the due amounts that your parties owe you. Receivable management helps increase sales resulting in increased profitability. Businesses can extend credit facilities to their customers which will help them boost their sales volume, as more customers would avail this facility by purchasing products on a credit basis.

Days Sales Outstanding (DSO)

- Regularly reviewing these reports helps ensure that all outstanding invoices are accounted for and that no unpaid debts have gone missing.

- Businesses can focus on improving their approach to accounts receivable (AR) management, and in the process unlock more cash, reduce operational costs, and improve overall efficiency.

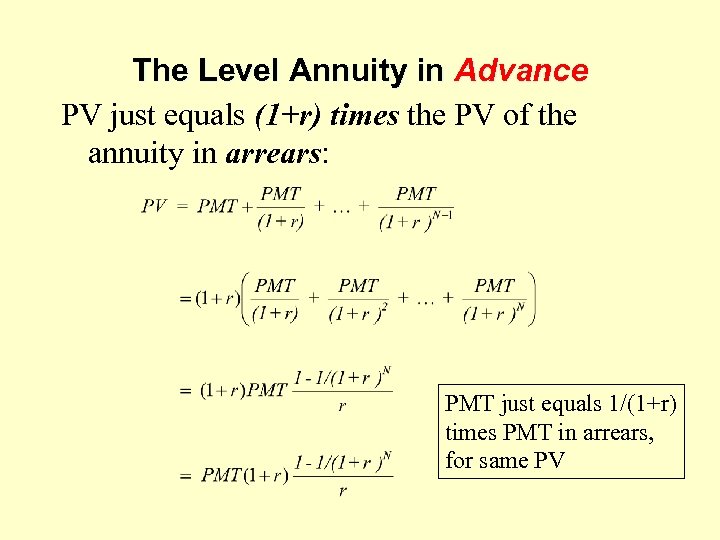

- At some point along the way, interest on the debt might also begin to accrue.

- You can handle a larger volume of transactions without a proportional increase in manpower or resources.

By offering a range of payment options, you enhance convenience for your customers, eliminating the need for them to disrupt their daily routines to fulfill payment obligations. Secondly, pay attention to the tone of your communication when sending invoices. Maintain a clear, concise, and polite approach in both the invoice content and accompanying email communication. Avoid clutter and ensure all necessary details are included for a smooth payment process.

It is typically expressed as a percentage of uncollectible debts relative to collectible ones, and the lower the percentage, the better. A receivable is created any time money is owed to a business for services rendered or products provided that have not yet been paid for. For example, when a business buys office supplies, and doesn’t pay in advance or on delivery, the money it owes becomes a receivable until it’s been received by the seller. It’s an asset because it has value, and it’s a current asset because it’s expected to be collected within the next 12 months.

Accounting for unpaid accounts receivable

FreshBooks accounting software offers an easy way to automate key aspects like invoice generation, late payment notifications, and payment processing. Try FreshBooks free to discover how the right accounting software can help you streamline your Accounts Receivable workflow today. Accounts Receivable is the amount a business holds in ongoing customer debts. An efficient Accounts Receivable process is key to ensuring good cash flow, maintaining positive customer relations, and collecting payments. There are a few big advantages to managing your accounts receivable effectively.

Providing multiple payment options improves AR management

Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields. This helps assess the efficacy of your Accounts Receivable process and what is a customer deposit provides an overview of your revenues for the month. Frequently reviewing and analyzing financial data is also important for re-assessing any strategies that need to be improved. Set up a system of late payment reminders on a set schedule—for example, reminders for 1 week, 2 weeks, and 3 weeks past due. It’s best to send a gentle reminder for the earliest contact and then include more formal documentation if the customer continues to ignore payment.

Prompt invoicing sets the stage for all subsequent steps in the AR process. It not only establishes how to answer what are your salary expectations payment terms but also greatly influences the speed at which payments can be collected. By ensuring invoices are sent promptly, you set a positive foundation for the entire payment collection process, enabling your business to receive payments promptly.

The 8 Accounts Receivable Process Steps

Since the funds are legally due to the business and can be used as collateral for loans, the money owed in Accounts Receivable is considered a liquid asset. Accounts receivable is one of the most important line items on a company’s balance sheet. It reflects the money owed to a company from the sale of its goods or services that remains to be paid by the buyer.

This process is essential for converting sales into actual revenue, which is vital for the financial health and growth of a business. Before we jump into the accounts receivable process, let’s clarify what accounts receivable is to make sure we know the basics. Yet, managing it effectively can be a complex task fraught with challenges—from delayed payments to reconciliation errors. A good set of credit policies will help the business extend constructive and reliable credit to its customers while minimizing the risk of default. Credit policies include such important guidelines as the criteria used for evaluating customers’ credit worthiness, limits on how much credit may be extended, and the terms for repayment of credit. Businesses that have accounts receivable, which is most, do so because they have extended credit to their customers.